Late enrollment frees hit some Medicare beneficiaries. A congressional bill would warn people of those charges before they happen

Mar. 12, 2022

What is the Medicare Part B late enrollment penalty?

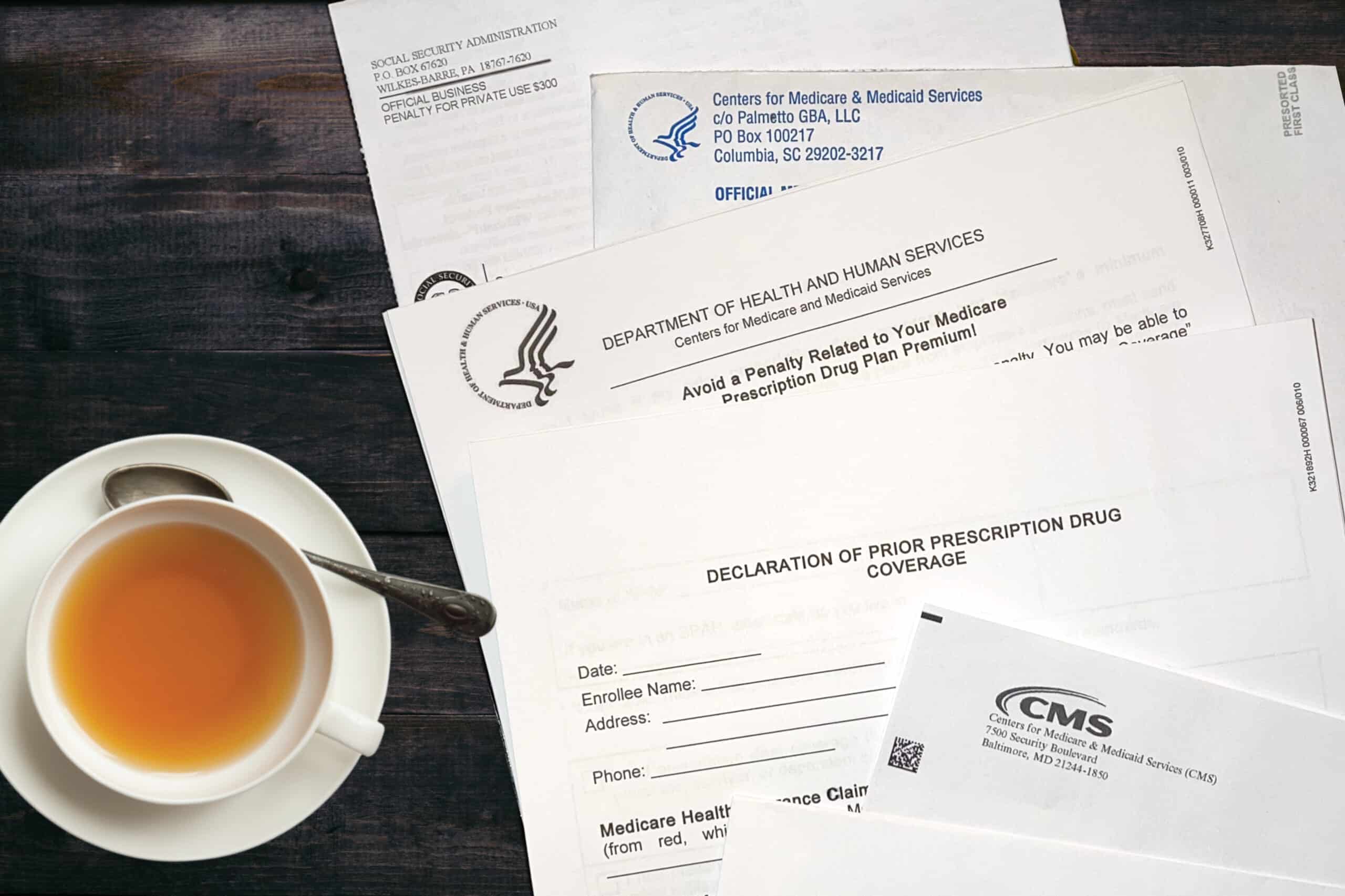

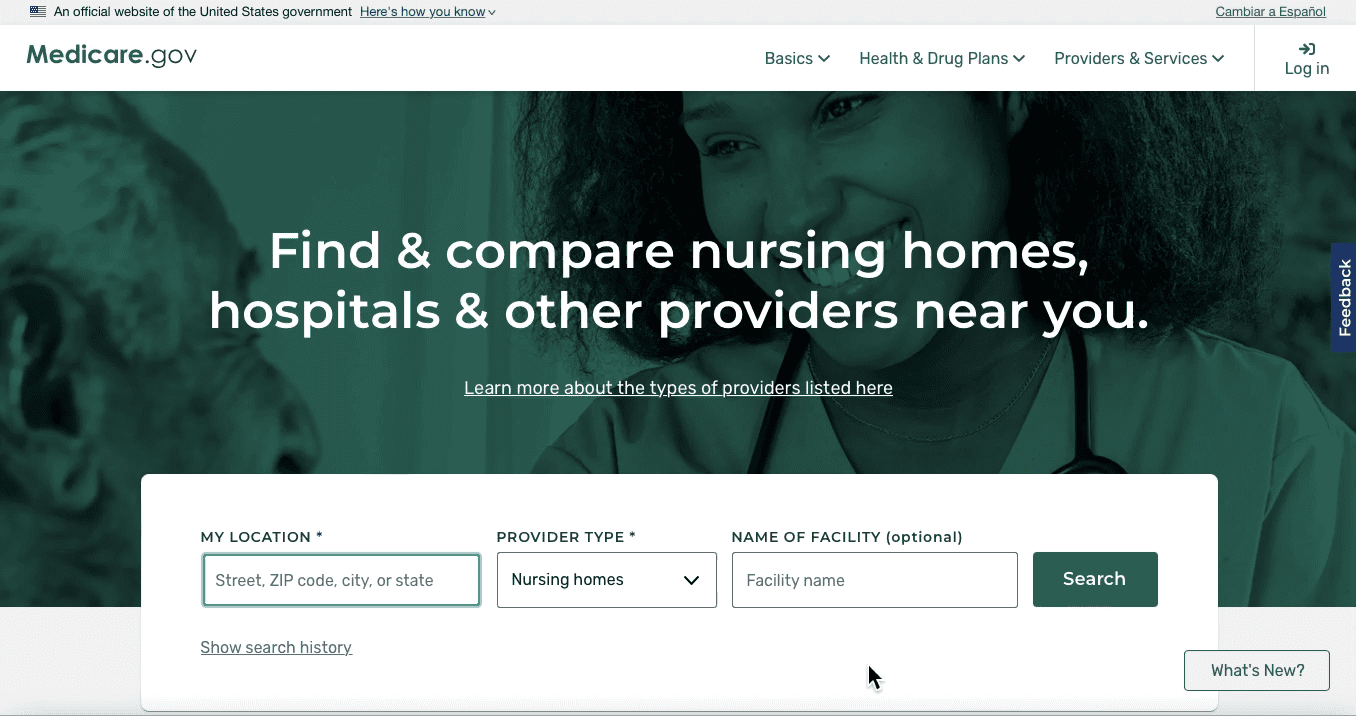

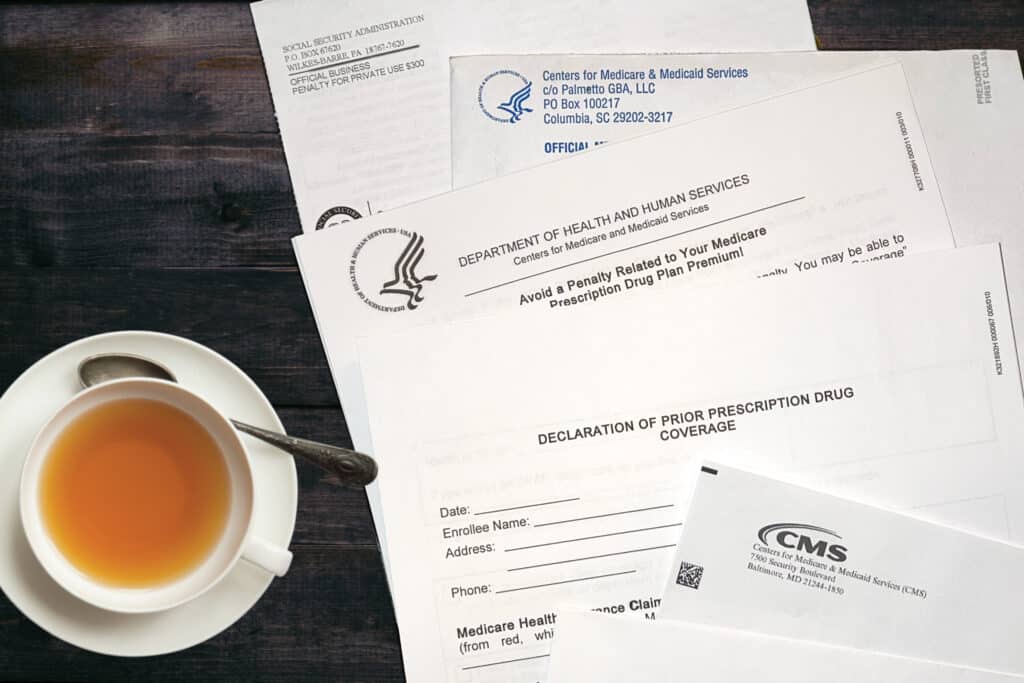

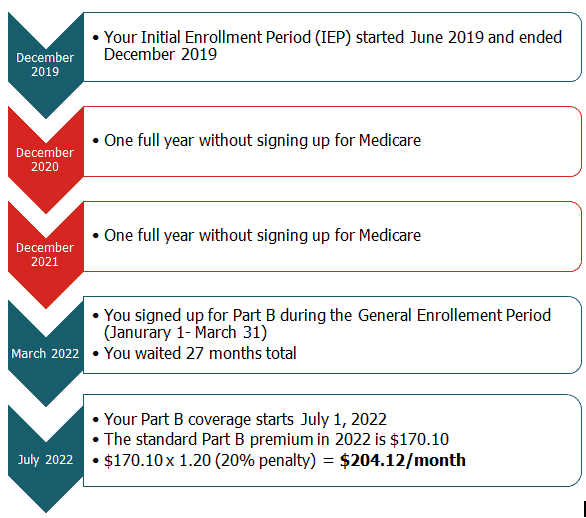

Certainly, there is a lot of confusion that arises when one nears his or her Medicare eligible age, 65-years old. Those with individual marketplace insurance, COBRA, or no insurance at all might consider delaying enrollment in Medicare to save on premiums. Unfortunately, the Centers for Medicare and Medicaid Services (CMS) does not consider COBRA or marketplace insurance as creditable coverage past the age of 65. CMS states on the Medicare.gov website that,

“If you didn’t get Part B when you’re first eligible, your monthly premium may go up 10% for each 12-month period you could’ve had Part B, but didn’t sign up. In most cases, you’ll have to pay this penalty each time you pay your premiums, for as long as you have Part B”

What is the Medicare Part D late enrollment penalty?

Generally, individuals with marketplace or employer insurance have their prescription coverage embedded in their medical insurance. This is not the case with Medicare. To obtain Part D, prescription drug coverage, you must enroll in either a stand-alone prescription drug plan or Medicare advantage plan with prescription coverage (MAPD). Those unaware of this fact may have to pay a late enrollment penalty if they do not sign up for a prescription coverage during their Initial Enrollment Period or after going 63 or more days without creditable coverage. In 2021, 12% of Medicare beneficiaries did not have creditable drug coverage and will face a penalty upon enrolling in a drug plan (Medicare Payment Advisory Commission, 2021). CMS states that, “The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Medicare calculates the penalty by multiplying 1% of the “national base beneficiary premium” ($33.37 in 2022) times the number of full, uncovered months you didn’t have Part D or creditable coverage. The monthly premium is rounded to the nearest $.10 and added to your monthly Part D premium.”