- March 24, 2022

- 8:37 pm

What is Long-Term Care?

Long-term care (LTC) encompasses a broad range of support services that are used for an extended duration to meet your personal, medical, and social needs for individuals who cannot fully support themselves. The aim is to uphold one’s absolute functional independence. LTC settings include an individual’s home, assisted living facilities, skilled nursing facilities, adult day care centers, and continuing care communities.

Statistics

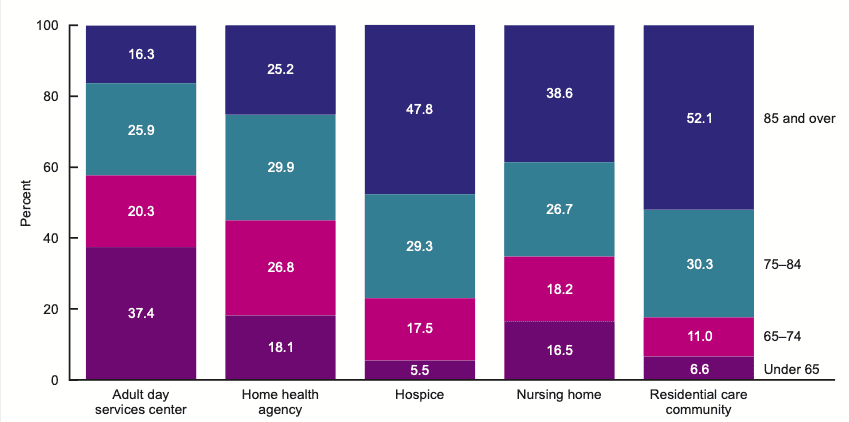

- In 2018, 72% of adult day services center (ADSC) participants were Medicaid eligible. About 57% of participants were female (Lendon & Singh, 2021).

Figure 1 Percent distribution of long-term care services users, by sector and age group: United States, 2015 and 2016 (Harris-Kojetin, et al., 2019)

- The average projected length of needing long-term care services is 2 years. However, about one-third of people turning age 65 are projected to need long-term care services for more than 2 years and to incur higher long-term care services costs (Lendon & Singh, 2021).

- Individuals turning 65 today have approximately a 70% chance of needing long term care in their final years (Administration for Community Living & Administration on Aging, How Much Care Will You Need?, 2018)

- Women need care longer (3.7 years) compared to men (2.2 years) (Administration for Community Living & Administration on Aging, How Much Care Will You Need?, 2018).

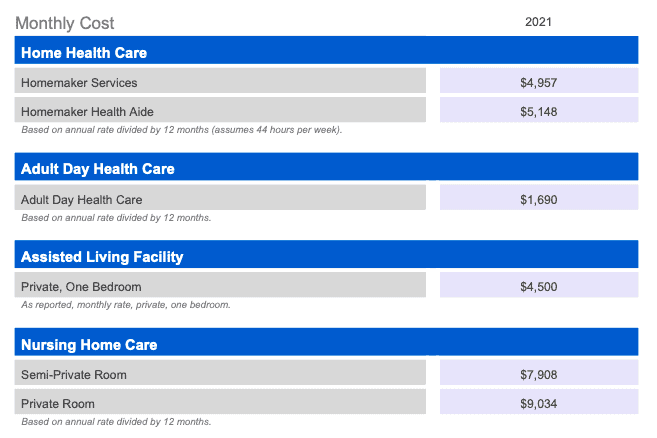

Costs at a Glance

A survey conducted by CareScout, a Genworth Company, reveals the median monthly cost of care for various long term care facilities from June to November of 2021. In 2022, a private room in a nursing home located in New Jersey, was estimated to cost $12,516/month accounting for 3% inflation.

.

Will Medicare Cover the Costs for Assisted Living?

Many individuals are under the false impression that Medicare- the federal health insurance program for the 65 and older population, the legally blind, individuals with end-stage kidney disease, and younger individuals who are disabled and collect Social Security disability benefits- will pick up the bill for their assisted living needs. Medicare does not cover long-term care, also known as custodial care. The same can be said for all Medicare Advantage plans and supplemental plans.

Will Medicaid Cover the Costs for Assisted Living?

Medicaid is a public insurance program jointly funded by federal and state governments dedicated for certain low-income people. As you may have already noticed, Medicaid covers nursing home care and long-term care (LTC) services at home and in the community. LTC eligibility and covered services vary from state to state.

Medicaid is the largest public source for LTC in the United States. (Administration for Community Living & Administration for Aging, Who Pays for Long-term Care?, 2020)

How Else Can I Pay for LTC Services?

Before you spend down all your assets, you should consider covering your LTC expenses using

- Current Savings and Investments

- Home equity through a reverse mortgage

- Annuities

- Whole Life Insurance

- Health Savings Accounts (HSAs)

Long-term Care Insurance

Frankly, long-term care insurance can be expensive, especially for individuals who are on a tight or low budget. Generally, premiums are based on health and age. Therefore, the longer an individual waits to purchase a policy, the more expensive the policy will be. Unfortunately, most individuals only start considering a long-term care policy once they see a need for it in their older years. As a rule of thumb, the premium should amount to no more than 5-7% of your income (National Association of Insurance Commissioners, 2019).

Plans can be very customizable and allow you to adjust for daily or monthly benefit amounts, the length of the elimination period, the duration of benefit payments, inflation protection, and nonforfeiture protection.

For more information on whether LTC insurance is right for you, visit A Shopper’s guide to Long-Term Care Insurance

References

Administration for Community Living, & Administration for Aging. (2020, February 18). Who Pays for Long-term Care? Retrieved from LongTermCare.gov: https://acl.gov/ltc/costs-and-who-pays/who-pays-long-term-care

Administration for Community Living, & Administration on Aging. (2018, February 18). How Much Care Will You Need? (Administration for Community Living) Retrieved March 10, 2022, from LongTermCare.gov: https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

Cost of care survey. (21). Retrieved March 10, 22, from Genworth: https://www.genworth.com/aging-and-you/finances/cost-of-care.html

Harris-Kojetin, L., Sengupta, M., Lendon, J., Rome, V., Valverde, R., & Caffrey, C. (2019). Long-term care providers and services users in the United States, 2015-2016. (43 ed., Vol. Vital Health Stats 3). National Center for Health Statistics.

Lendon, J. P., & Singh, P. (2021). Adult day services center participant characteristics: Unites States, 2018 (Vol. NCHS Data Brief No. 411). Hyattsville, MD: National Center for Health Statistics.

National Association of Insurance Commissioners. (2019). A Shopper’s Guide to Long-Term Care Insurance. Kansas City, Missouri.