What is long-term care and when should you start planning...

Read MoreACA Compliant Health Insurance In New Jersey

GET AN INSURANCE QUOTE

Health Insurance Options for People Under 65

The majority of individuals and families have health insurance in NJ through their employers. You’re likely best off with your employer’s group plan than any other option available to you. Group coverage is easier and much less expensive to get than private insurance. Plus, your employer may pay most or all of the cost for you, and you can’t be denied coverage. However, if you change jobs, get laid off, or are fired, you can lose your group health insurance. If you find yourself without employer-sponsored health insurance or Cobra, the following options may be available to you:

Prescription Plans:

Individual Health Insurance In New Jersey: Perhaps your employer doesn’t offer health insurance, or you’re self-employed, a student, or retired before age 65. If you’re relatively healthy, you should purchase an individual health insurance policy. You can buy a policy on the marketplace or off the marketplace.

Under 65 Health Insurance - Affordable Care Act (ACA):

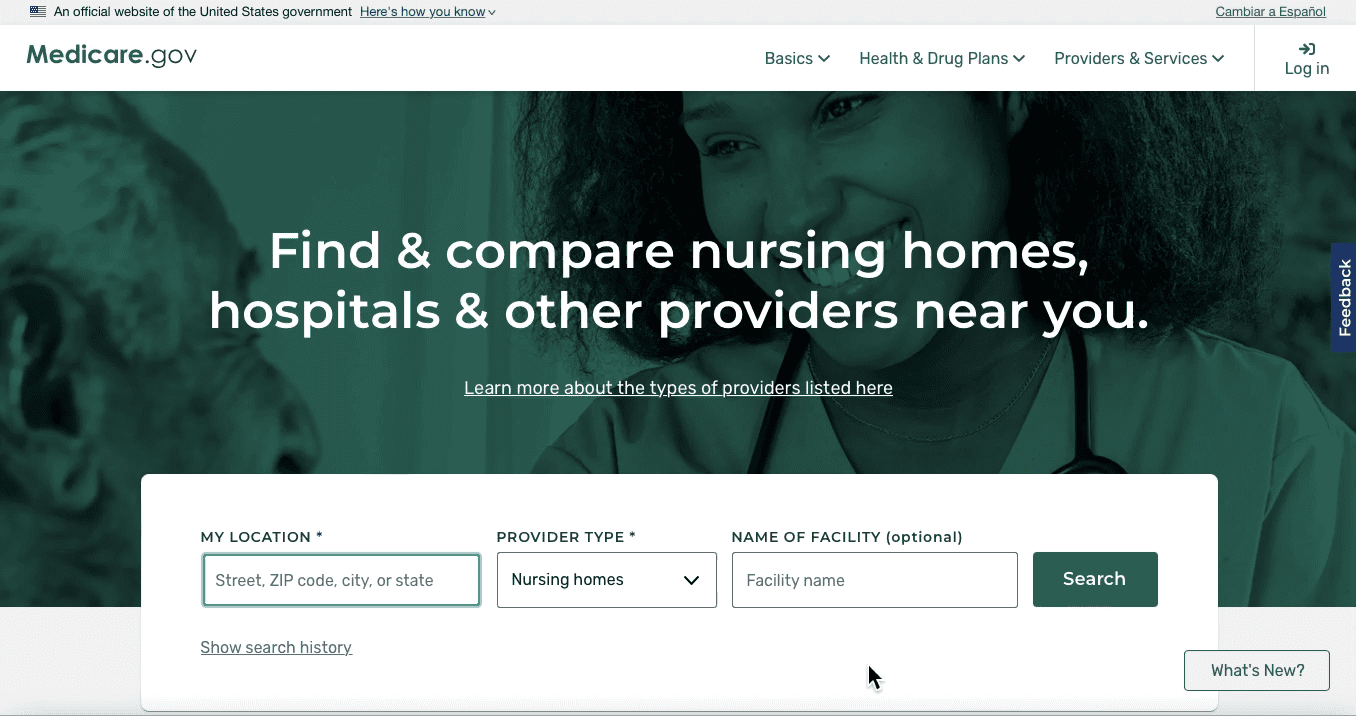

Get Covered New Jersey is the state’s official health insurance marketplace where individuals and families can easily shop for and buy coverage. It is the only place you can apply for financial help to lower the cost of your monthly insurance premiums and out-of-pocket costs.

Get Covered New Jersey offers financial help to qualifying residents to help lower their monthly premiums and out-of-pocket expenses. In New Jersey, a family of four earning up to about $104,800 a year and an individual earning up to about $51,040 a year may qualify for financial help to lower their coverage costs. You can learn if you might qualify for free or low-cost health insurance through NJ FamilyCare, New Jersey’s publicly funded health insurance program.

How would I enroll?

Fill out the form and we will be in contact soon or press the “Click to Call” button above to call us today!

ACA Health Insurance FAQs

What is the health insurance marketplace?

Each state has its own official health insurance marketplace, for instance, New Jersey’s official health insurance marketplace is GetCoveredNJ. Enacted in 2010, the Affordable Care Act was designed to subsidize health insurance plans based on numerous factors including income, household size, and gender. Each state’s marketplace is the only place where you can receive financial assistance to lower premiums, copays, and deductibles.

What kinds of financial assistance are offered through the marketplace?

Assistance can be provided through premium tax credits, cost sharing reductions, and New Jersey Health Plan Savings.

What are premium tax credits?

Premium tax credits help decrease your monthly premium payments and apply to all income levels to ensure that no household contributes more than 8.5% of income toward a benchmark plan-the second lowest premium Silver Plan in the consumers region- offered through the marketplace. The marketplace, or government, will forward your tax credit directly to your insurance carrier. This is considered an advanced payment of your premium using a tax credit. Make sure when you are applying for financial assistance through the marketplace that you slightly overestimate your current annual income as you will have to “reconcile” upon filing your federal income taxes using IRS form 8962. This will compare how much tax credit you used vs the amount you actually qualified for. If you made more money than expected, you may owe money in your taxes, whereas, if you made less, you may be refunded the difference. Premium tax credits can be used toward any plan level: bronze, silver, or gold.

What are cost-sharing reductions?

Those who qualify for a premium tax credit and have household incomes between 138% and 250% of the federal poverty level qualify for cost sharing reductions that decrease your out-of-pocket expenses such as copays, coinsurance, deductibles, and annual maximum out-of-pocket amount. To use these additional savings, you must enroll in a Silver level plan. You will be able to apply both your premium tax credits and cost-sharing reductions with a Silver level plan.

What are New Jersey Health Plan Savings?

Households with annual incomes up to 600% of the federal poverty level- in 2022, an individual making up to $77,280 and a family of four making up to $159,000- will be eligible for a subsidy through the New Jersey Health Plan Savings that lowers their health plan premiums.

What is NJ FamilyCare?

NJ FamilyCare is the state of New Jersey’s Medicaid program. To be eligible your income must be at or below 138% of the federal poverty level. If upon completion of your GetCoveredNJ application you are deemed eligible for NJ FamilyCare, you will not be able to receive financial assistance through the marketplace. In other words, you cannot refuse Medicaid for marketplace insurance.

What if my income increases or I lose a taxable household member? What if my income decreases or I gain a household member? How will this impact my marketplace financial assistance?

Provided that the premium tax credit operates on a sliding scale, both situations would decrease your financial assistance. Oppositely, if your income decreases or you gain a household member, you may be eligible to receive more savings or credit. It is imperative that you update your GetCoveredNJ application within 30 days as these situations arise to ensure that you a) you do not owe money back come tax season or b) you maximize your insurance savings.

How will I find out how much financial assistance I am eligible for?

After entering your basic information on the GetGoveredNJ share and compare tool, you will be able to view estimates of how much assistance you may be able to receive. Estimates are great, but if you want to know exactly how much you are eligible for, you will need to complete an application on the website. Immediately after the application is submitted, official eligibility results will be presented to you.

If I have a pre-existing condition, will I be denied coverage or have to pay a higher premium?

You cannot be denied a policy for having a pre-existing health condition, nor can the insurance company deny claims upon issue of the policy for any pre-existing conditions. Additionally, the insurance company cannot charge you more for having any pre-existing conditions.

Are New Jerseyeans required to have health insurance?

Yes. If you do not have health insurance in the state of New Jersey, you will receive a “shared responsibility payment (SRP)” during tax season, unless you are eligible for an exemption. The SRP amount is based on both your income and family size and is capped at the average annual premium for a Bronze level plan in New Jersey. The amount you owe will also depend on how many months you went without coverage. To calculate your SRP visit, https://nj.gov/treasury/njhealthinsurancemandate/nj-himpa-calc.shtml

When would someone need marketplace insurance?

Individuals who would need marketplace insurance include:

- Individuals who do not receive medical benefits through their employer or parents

- Individuals who retired before being eligible for Medicare (65 years old)

- Individuals who are transitioning careers and will have either a short or long gap in coverage. It may be frustrating, but some people will need to apply for marketplace insurance even if it is only for one month.