Other Insurance

GET AN INSURANCE QUOTE!

Hospital Indemnity Insurance:

Hospital indemnity insurance, also called hospitalization insurance or hospital insurance, is a plan that pays you benefits when you are confined to a hospital, whether for planned or unplanned reasons, or for other medical services, depending on the policy.

These are specifically designed to help you fill gaps in your Medicare Advantage coverage by providing cash to help cover copays, coinsurance, deductibles, pharmacy prescriptions and other non-covered expenses that may arise from hospital stays and services.

Why Hospital Indemnity?

Hospital stays can strain even the healthiest of budgets. And in many cases, you can’t ignore the care you need even if it pushes you financially. Hospital indemnity insurance plans provide payment for each day spent in the hospital, and for some other qualified expenses as well. That’s money you can use as you choose, whether for hospital bills or those other costs that come up while you’re recovering.

GET AN INSURANCE QUOTE!

Cancer/Heart Attack/Stroke Insurance

Cancer, heart attack, and stroke can happen at any time to anyone. Even those who live a healthy lifestyle run the risk of being diagnosed with one or more of the illnesses. No one likes to think about the possibilities but the risks are very real.

Treatment is very expensive and can cause your other financial obligations to fall behind. The solution is an insurance plan that can pay you a lump sum in the event of one of these diagnoses. You can obtain a plan that covers just one of these catastrophic situations or you can get a plan that helps cover all three!–Information provided by Aetna Insurance Company

WHY CANCER/HEART ATTACK/STROKE INSURANCE?

Heart Attack is the number one cause of death for both men and women in the United States! More than 920,000 Americans will have a heart attack this year and half will occur with no warning signs.

Cancer is the second most common cause of death. 1 out of every 4 deaths. About 77% of all cancers are diagnosed in people who are 55 or older. Statistically 1 in 2 men and 1 in 3 women will develop cancer during their lifetimes.

Stroke is the third leading cause of death in women, the 5th leading in men, and among the top 10 in children. Stroke reduces mobility in more than half of stroke survivors 65 and older.

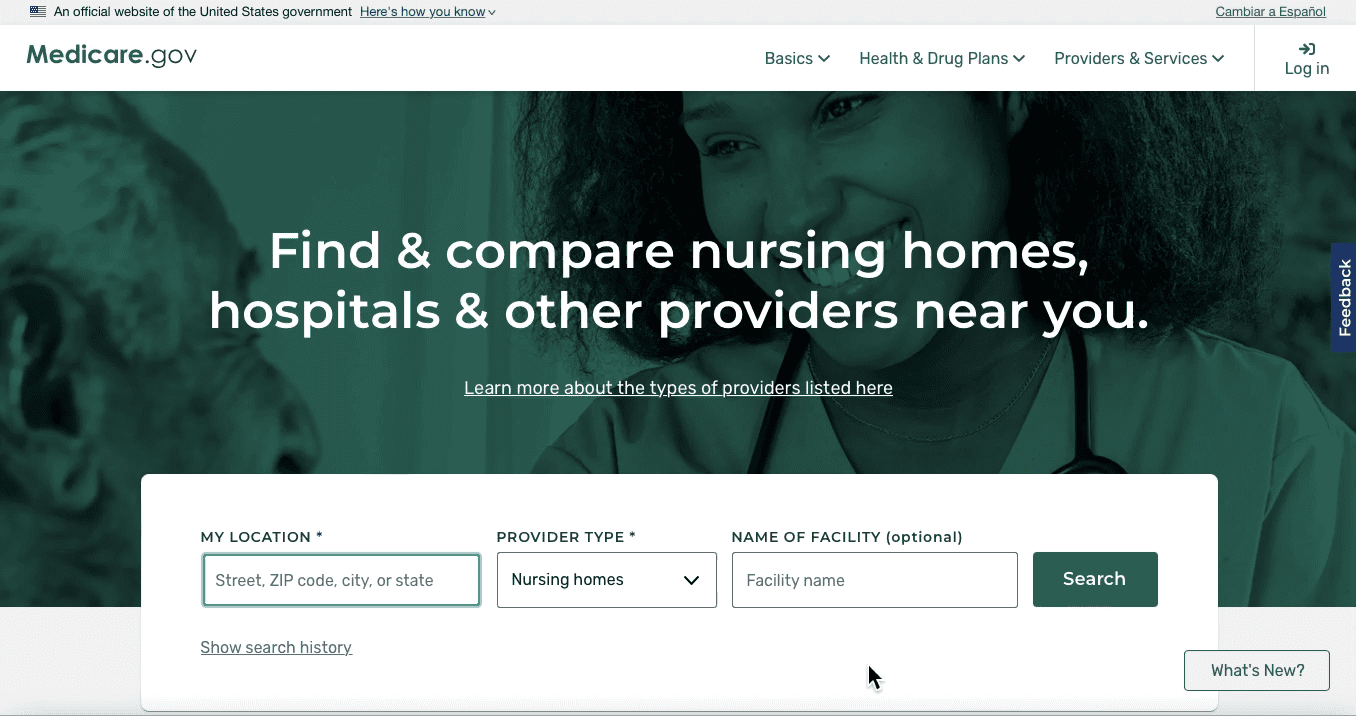

How would I enroll?

Fill out the form and we will be in contact soon or press the “Click to Call” button above.

GET AN INSURANCE QUOTE!

Lifetime Income

Income Strategy Session

Our main goal with our strategy sessions is to evaluate and design a plan that allows you to continue living the lifestyle you desire to live with the nest-egg you have built. We believe that a solid retirement income strategy is the best way to have that assurance – for everyone.

We know that the circumstances of life can change. As trained professionals, our goal is to be her to work with you over the long term. We know that your retirement strategies must continue to provide the level of income you need throughout your life. So, even if things change, we’re here to help you update your strategy.

The majority of our clients fall into one or more of the categories below. Determining which category, you fall into will help know better which strategy will work best.Which of the following would you say is closest to your current situation?

Healthy, active person planning retirement around the things they love… Whatever your hobby or passion, you want to feel confident that you have the income to support your lifestyle. Retirement income assessment and management can help you feel assured that you will have that income. As part of this group, your strategy should stress stability, income and the possibility of asset growth.

Seniors facing medical issues that will impact their retirement decisions… Unless you’ve been there, it’s difficult to imagine the devastation of a life-altering diagnosis. Concern for medical bills can be an ongoing factor. We can help you arrange for steady, lifetime income** and principal protection. What’s more, there are annuity contracts or riders* that provide increased income* – potentially double or triple – for qualifying healthcare conditions.

Adult children who hold Power of Attorney (POA) for a parent or those with an adult child who will manage your finances eventually... Whether you’re a child holding a Power of Attorney, or a parent planning to turn over control in the coming years, there are many considerations regarding the goals and assets involved. As your financial professionals, we can streamline that discovery process. We will work with you to address many of your concerns. We want you to enjoy the time you get to spend with your family.

Widowed or single seniors who are very independent… This group is diverse, but one thing most seniors have in common is that you do not want to become dependent on your families or friends in case of disability or other economic challenges. You worked hard all your life, have been a provider, and are not comfortable with the idea of relying on others. We understand independence and can help design strategies that provide for guaranteed and steady lifetime income, designed to help ease your mind and more confidently position yourself for the future.

What should I do next?

Identify the category that best fits you and contact us to schedule your free strategy planning session. You can also press the “Click to Call” button above to reach us today.