New Jersey Medicare Insurance Agents

GET AN INSURANCE QUOTE

Medicare Supplement Plans In NJ

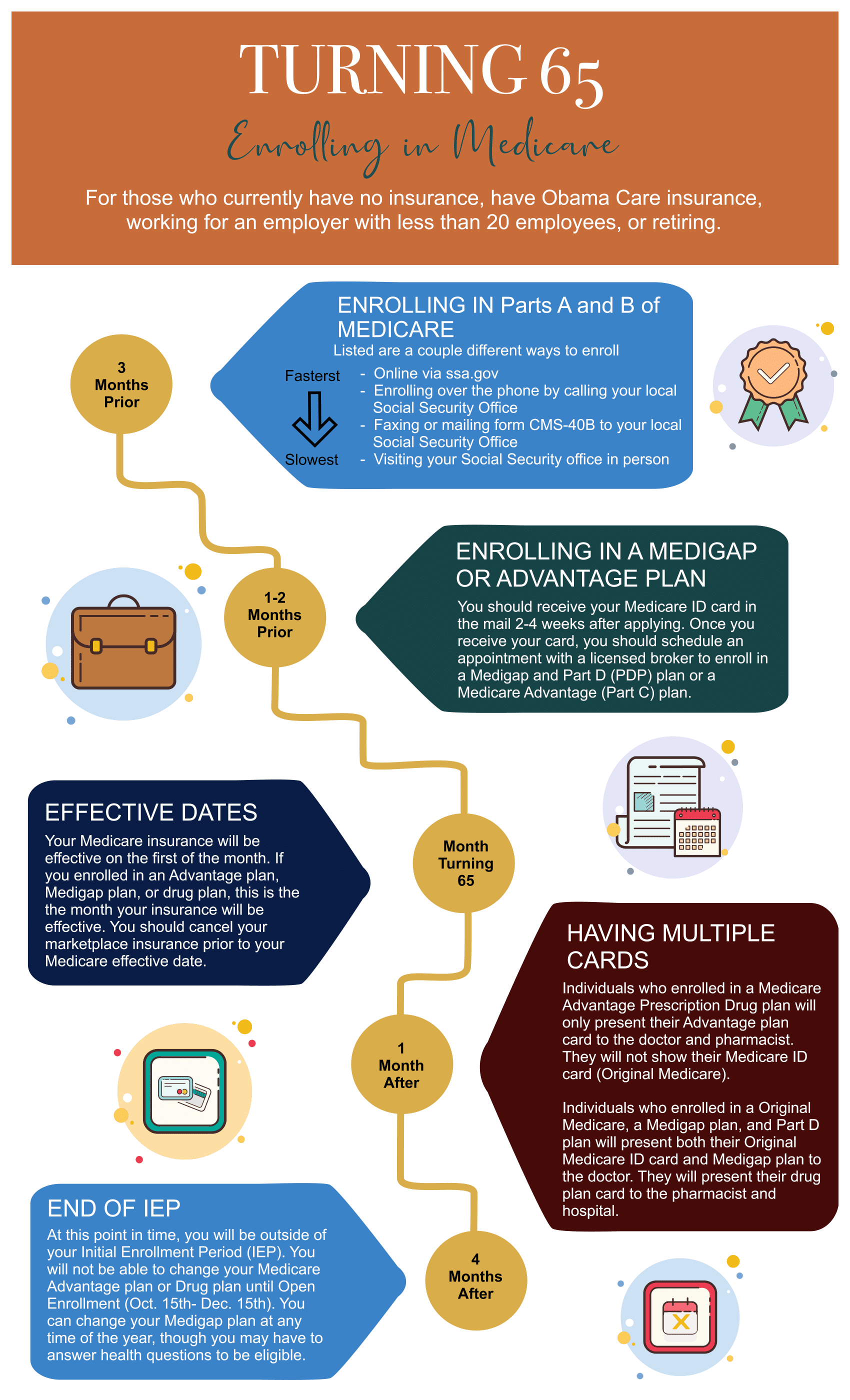

What is a Medicare Supplement?

Medicare Supplements, also known as Medigap policies, are sold by private insurance companies to help you cover the out-of-pocket costs left behind by Medicare.

What do Medicare Supplements Cover?

When you have a Medigap policy, Medicare pays up to its limit on your medical expenses. Then, your Medicare Supplement plan starts to help with covering costs up to the plans limit. That limit usually covers what Medicare doesn’t, however, that will depend on which policy you select.

Is there anything not covered?

Things that are not covered by Original Medicare on your Medicare Supplement:

- Routine dental, vision, and hearing exams

- Hearing aids

- Eyeglasses or contacts

- Long-term care or custodial care

- Retail prescription drugs

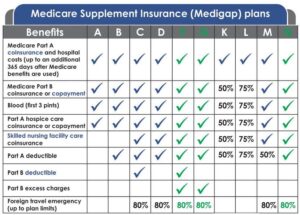

Which Medigap Plans Can I Choose From?

What do Medicare Supplements cost?

Cost will vary along with plan type from county to county. The best thing to do is schedule a consultation with us so that we can review which plans are available in your area and determine the best plan and price for you. You can also press the “Click to Call” button above to reach us today!

A Guide to Health Insurance for People with Medicare

GET AN INSURANCE QUOTE

Medicare Advantage Plans In NJ

What is a Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a plan provided by private insurance companies with the help from subsidies provided by the government so that the insurance company can design network based plans at a low or zero premium.

These plans are normally designed with copays and coinsurance throughout the plans as a form of cost share that the client would assume when joining one of these plans. Most plans will include additional benefits at no additional cost to you such as dental, vision, and/or hearing benefits as an example. So let’s take a closer look at New Jersey Medicare Advantage Plans.

- It’s often less expensive to choose a Medicare Advantage plan.

- It’s convenient to have a single plan for everything

- The plan covers everything traditional Medicare covers (hospital insurance and medical insurance) as well as emergency and urgent care

- Many plans also cover dental care, eyeglasses, and wellness programs

- Most plans also include prescription drug coverage

- Your eligibility isn’t affected by health or financial status

- Premiums are low

- You’re restricted to certain doctors in your network (unless it’s an emergency)

- Plan premiums can change from year to year

- Difficult to switch to Medigap later on

- Plan benefits can change from year to year

- You’re subject to high deductibles and co-pays

Health Maintenance Organization (HMO) plans: In most HMOs, you can only go to doctors in your network (except in an urgent or emergency situation). Preferred Provider Organization (PPO) plans: In a PPO, you pay less if you use doctors in your network. You usually pay more if you go outside of your network.

Private Fee-for-Service (PFFS) plans: PFFS plans are similar to Original Medicare in that you can generally go to any doctor as long as they accept the plan’s payment terms. The plan determines how much it will pay and how much you must pay when you get care

Special Needs Plans (SNPs): SNPs provide specialized health care for specific groups of people, like those who have both Medicare and Medicaid, live in a nursing home, or have certain chronic medical conditions. HMO Point-of-Service (HMOPOS) plans: HMO plans may allow you to get some services out-of-network for a higher copayment or coinsurance.

Cost will vary along with plan type from county to county. The best thing to do is schedule a consultation with us so that we can review which plans are available in your area and determine if the plans available would offer you additional benefits such as dental, vision, and hearing benefits. You can also press the “Click to Call” button above to reach us today!

Medicare Prescription Drug Plans In NJ

How Do Prescription Drug Plans Work?

Medicare drug coverage helps pay for prescription drugs you need. Even if you don’t take prescription drugs now, you should consider getting Medicare drug coverage. Medicare drug coverage is optional and is offered to everyone with Medicare. If you decide not to get it when you’re first eligible and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later. Generally, you’ll pay this penalty for as long as you have Medicare drug coverage. To get Medicare drug coverage in New Jersey, you must join a Medicare-approved plan that offers drug coverage. Each plan can vary in cost and specific drugs covered.

There Are 2 Ways to Get Medicare Drug Coverage in New Jersey:

1. Medicare drug plans. These plans add drug coverage to Original Medicare, some Medicare Cost Plans, some Private Fee‑for‑Service plans, and Medical Savings Account plans. You must have Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) to join a separate Medicare drug plan.

2. A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. NJ Medicare Advantage Plans include:

- Health Maintenance Organizations

- Preferred Provider Organizations

- Private Fee-for-Service Plans

- Special Needs Plans

- Medicare Medical Savings Account Plans

How would I enroll?

There are roughly 30 drug plans in each area to choose from. We can help you find the lowest combination of premiums and copays based on your unique medications. We will also help you understand star ratings, drug tiers, customer service and deductibles. Fill out the form and we will be in contact soon or press the “Click to Call” button above to call us today!

NJ Medicare Insurance FAQ’s

Do I need to receive Social Security benefits in order to take Medicare?

A huge misconception is that you must enroll in Medicare and Social Security benefits at the same time. That is false. Although enrolling in Medicare requires you to contact the Social Security Administration either online, over the phone, or in person, you do not have to start collecting Social Security benefits upon Medicare enrollment.

I’m still working and have employer insurance. Do I still need to sign up for Medicare?

You do not have to take Medicare insurance in New Jersey simply because you are turning 65. As long as you have insurance through an employer or spouse, you will not accrue any Part B or D penalties. However, you should review your current coverage- premium, deductible, copays, coverage history, and network- to determine if Medicare would be more suitable for you.

What should I consider when shopping around for Medicare Supplemental plans?

Provided that each supplemental plan G (N, C, D, etc.) offers the same benefits, the only major difference among policies is the premium. You will not receive more benefits by paying a higher premium for your plan and vice versa. In addition to searching for a plan with a low/fair premium, you should also consider a carrier’s rate increase history. Unfortunately, these numbers are not available to the public. This is when a broker becomes your best friend. After working many years in the insurance industry, a broker becomes familiar with each company’s rate increases and can bring you into the loop.

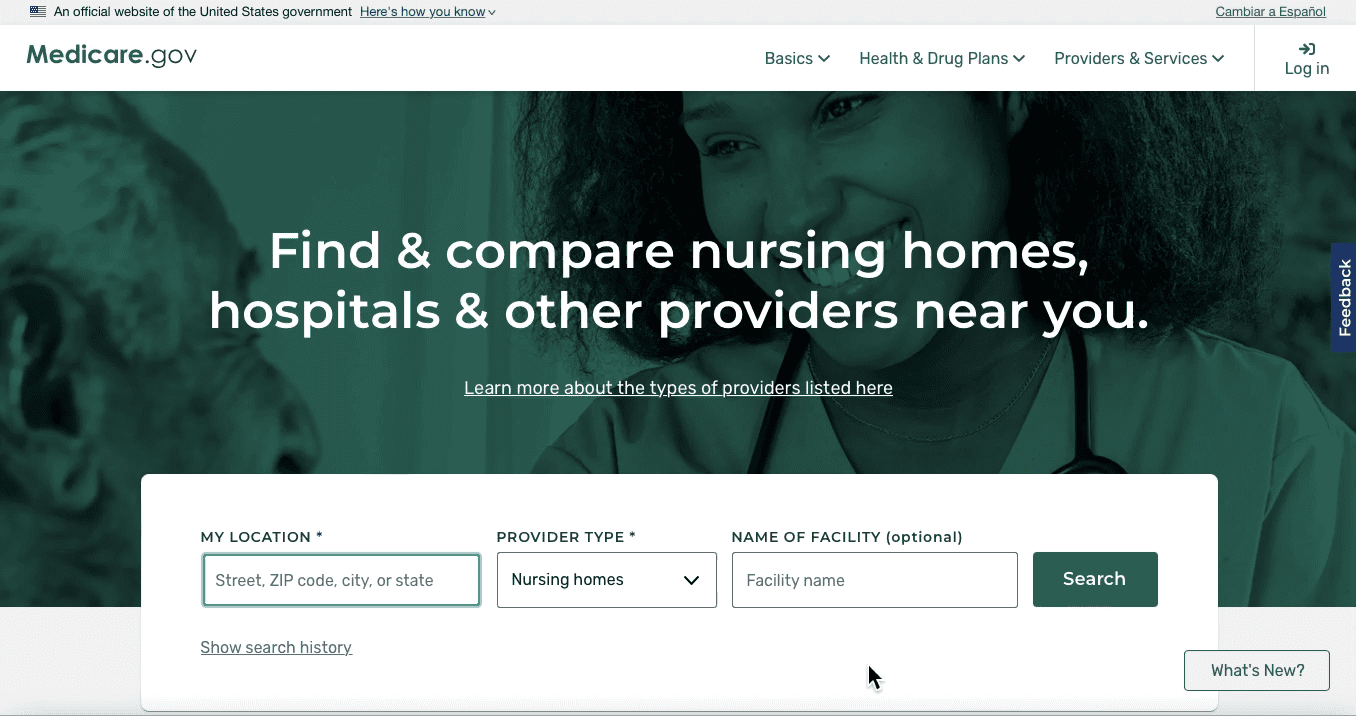

Where can I find company specific information on Medicare Supplemental plans?

This is a common question amongst clients. Many individuals want to know what procedures and services each supplemental plan covers when, in fact, the answer is very simple. All Medicare supplemental plans in NJ (F, G, N, C, D, etc.) will cover all medically necessary services approved by Medicare. Put simply, if Medicare approves the service, your supplemental plan will pay its share. Per the Centers for Medicare & Medicaid Services, “The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.” This means that every plan G (N, C, D, etc.) is identical by law. The Medigap charts you keep seeing on Google are the only plan specific material available to you and your broker.

Do I have to wait until Open Enrollment to switch my Medigap plan?

Fortunately, you do not have to wait until Open Enrollment to switch your Medigap plan. You can switch at any time of the year and as many times as you would like if you can make it through underwriting. Each time you try to switch from, for instance, a Plan G to another Plan G or from a Plan G to a Plan N, you will need to answer health questions written by the insurance company. Even if you are trying to switch your plan but stay with the same company, you will still need to go through underwriting. You never lose anything by trying to switch plans and rest assured, your current insurance carrier will not be upset that you are trying to switch to another company.

What’s the difference between Parts and Plans?

When conversing about Medicare, we have noticed that some individuals will use the two terms interchangeably when there are stark differences between Parts and Plans. All Medicare Parts- A, B, C, and D- pertain to types of insurance; Part A refers to hospital insurance, B to medical insurance, C to Medicare Advantage plans, and D to prescription drug coverage. Generally, when we talk about plans, we are referring to Medicare Supplemental plans (Medigap). There is an alphabet of plans- G, N, C, D, F, etc.- though, unlike Medicare Parts, these are not different types of insurance, rather, they are all supplemental plans that cover different out of pocket expenses associated with Parts A and B of Medicare. If you tell a broker that you want a plan D, the broker is going to assume that you are on Social Security disability and wish to enroll in a Medigap plan rather than a drug plan, Part D, so make sure you know that difference between your Parts and Plans.

I’m eligible for Medicaid. Do I still need a Medigap plan to supplement my Medicare benefits?

Being that Medicaid acts as secondary/supplemental insurance to your Original Medicare benefits, enrolling in a Medigap policy would not be necessary. Though, you can consider enrolling in a Dual Special Needs Plan (DSNP) that integrates your Medicare and Medicaid benefits and provides you with additional benefits such as over-the-counter discount cards, fitness benefits, and more. By enrolling in a DSNP, you do not lose any of your Medicare or Medicaid benefits.

How long does an appointment generally last?

An appointment dedicated to going over the basics of Medicare can range anywhere between 1-1.5 hours depending on how many questions you have. Whether you think you know it all, the Medicare insurance broker in New Jersey will still go over everything you will need to know about Medicare to ensure that your research has been thorough and to ensure that he/she is staying compliant with Medicare’s guidelines.

What is a Scope of Appointment?

A Scope of Appointment (SOA) documents the scope, the extent of the matter you are dealing with- of the sales appointment prior to any face-to-face meeting to ensure that both parties understand what is going to be discussed. This form is required by the Centers for Medicare & Medicaid services. By signing the form, you are not obligated to enroll in any Medicare plan discussed. Should you call any insurance company and ask to go over plan specific information pertaining to Medicare, make sure that you fill out a scope of appointment. If the person you are speaking with does not ask you to complete this form verbally or electronically, hang up the phone immediately as the individual is not following Medicare guidelines.

How do you get paid?

Medicare insurance brokers in NJ get compensated directly or indirectly from the insurance company. Most Medicare brokers make commission only, while medicare insurance agents for a company may make both salary and commission.