Dental Insurance NJ

GET AN INSURANCE QUOTE!

Why Do You Need Dental Insurance?

Insurance may seem like just another unwanted expense however once you learn why these types of insurance plans are important you will realize they are definitely worth it. Dental, vision and hearing health is linked to your overall well-being. This type of insurance coverage will give you peace of mind and help you save money in the long run. And believe or not, these insurance plans don’t have to be expensive either!

Dental insurance in NJ protects you during worst-case situations. However, it isn’t like other insurance, such as home insurance, where the danger of not having it is so significant that you can’t afford not to have it. Whereas with dental insurance, the risk is smaller, as is the reward.

While it’s true that some years you’ll likely only need to go for routine cleaning and perhaps x-rays, there may come a time when you need to go for several procedures, such as fillings and a root canal or crown treatment. It is during these times that dental insurance is critical, as these procedures may cost a lot of money upfront, and you may not always have cash on hand. Having dental insurance means that at least a portion of this cost will be covered, giving you financial relief as well as the ability to attend to your dental requirements if and when they arise.

Adults over the age of 65 may benefit the most from dental insurance. NJ Dental insurance plans for seniors are tailored to the needs of older adults, and include coverage for dentures, root canals, and crowns. Coverage focuses on treatments that are more likely to be required by seniors, although they are not exclusive to them alone.

What is Dental Insurance?

Dental insurance is a type of insurance that provides cover for a range of procedures that are performed by a dentist. Depending on the specific plan, covered treatment may include basic preventative dental treatments, such as dental checkups, cleanings, and x-rays, as well as restorative treatments, orthodontic treatments, and specialty treatments.

GET AN INSURANCE QUOTE!

How Does Dental Insurance Work?

Most dental insurance plans in NJ work as follows:

Your insurer charges you a monthly premium in exchange for dental insurance. Individual plans are paid directly to the insurer, whereas employer-sponsored plans are often taken from your salary. A waiting period may apply for dental treatments other than basic routine dental checkups. The maximum amount of time that you may need to wait before you’ll be able to claim for covered treatments is usually 6 to 12 months.

In addition, certain plans may require you to have a primary dentist or select a dentist from their plan network. Many plans also include deductibles. This refers to the portion of a treatment’s cost that you need to pay out of your own pocket, which is not paid for by your dental insurance plan. Essentially, dental costs are shared between you and your insurance plan, which is known as coinsurance.

GET AN INSURANCE QUOTE!

Which Dental Insurance Plan Do You Need?

Ideally, your NJ dental insurance plan will allow you to choose your dentist. Your dentist should be someone you trust, feel comfortable around, and that charges fees that align with what you are able to afford. Your insurance also needs to cover the procedures that you or your loved ones are most likely to require.

Dental Insurance Plans in NJ for individuals are reasonably priced and can offer coverage for both preventative and comprehensive coverage.

Jersey Senior Advisors can show you numerous coverage options you can tailor to your priorities and budget including both dental insurance NJ and discount plans.

GET AN INSURANCE QUOTE!

Why do I need these plans?

Insurance may seem like just an another unwanted expense however once you learn why these types of insurance plans are important you will realize they are definitely worth it. Dental, vision and hearing health is linked to your overall well-being. This type of insurance coverage will give you peace of mind and help you save money in the long run. And, believe or not, these insurance plans don’t have to be expensive either!

Jersey Senior Advisors can show you a number of coverage options you can tailor to your priorities and budget.

Insurance Quote

GET AN INSURANCE QUOTE!

Dental Coverage

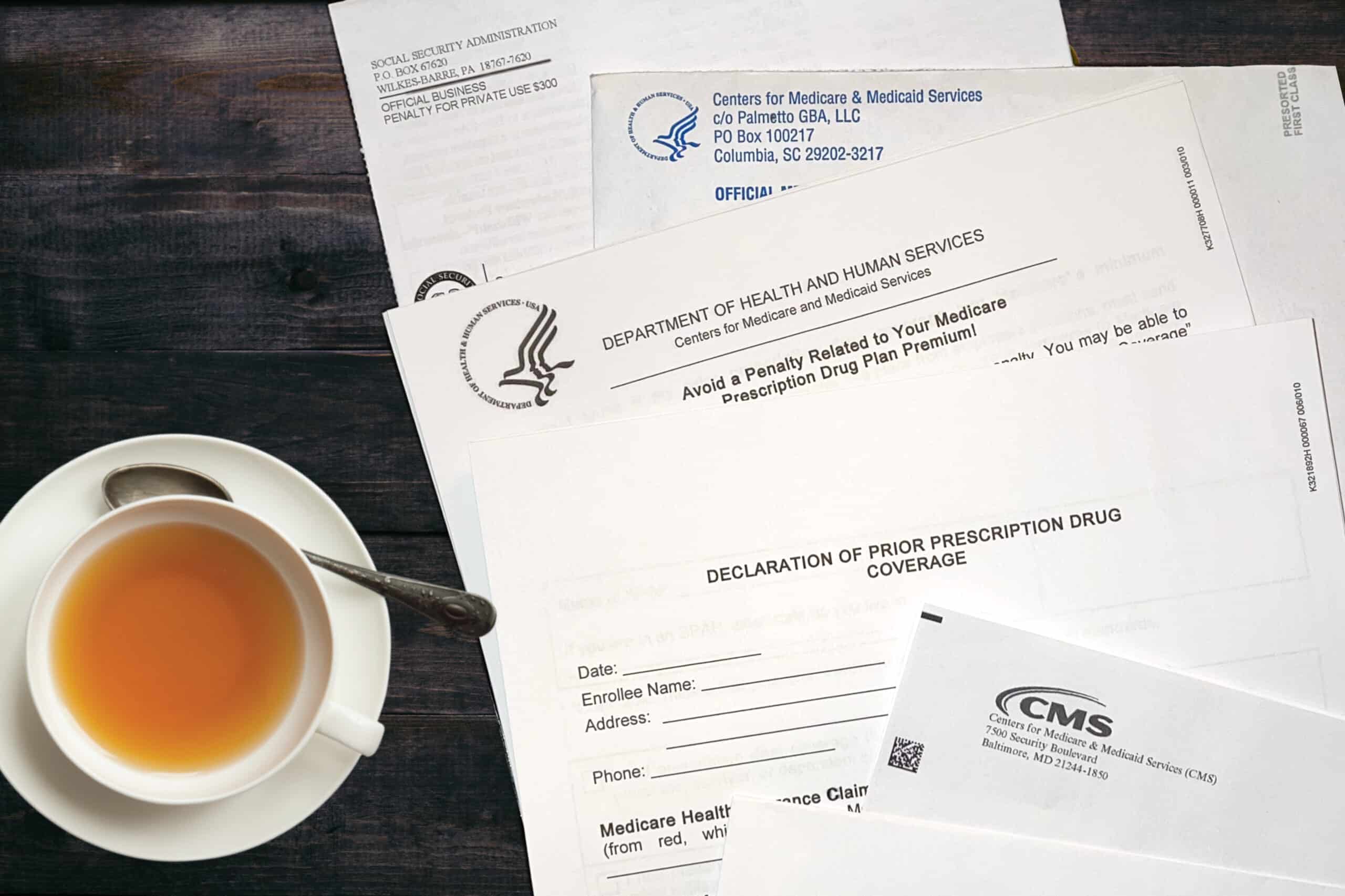

Medicare has very limited dental coverage that is only meant to protect your general health in order for another Medicare-covered health service to go smoothly.

It does not cover routine checkups, cleanings, fillings, dentures (full or partial), or most tooth extractions. Medicare Supplements also will not cover these additional benefits.

On the other hand, certain Medicare Advantage plans will sometimes include additional dental benefits as part of their network based plan.

Medicare Beneficiary?

Ultimately what we have found works best is for our clients is to enroll in a stand alone plan that combines the dental, vision and hearing benefits. The monthly premium is low and allows you to have more coverage than what you would normally be provided otherwise with just original Medicare.

How would I enroll?

Fill out the form and we will be in contact soon or press the “Click to Call” button above.

Insurance Quote

NJ Dental Insurance FAQs

What is a dental discount plan?

Also called dental savings plans, these low premium plans allow members to save between 10-60% on typical dental procedures. Plan members simply show their cards to participating providers and pay the discounted rate to the receptionist. These plans have no deductibles, copays, annual limits, or waiting periods. You simply have a coinsurance that varies based on the procedure performed. Generally, these plans are geared towards individuals who do not need major work or who have exceeded their current dental plan’s annual limit. For more information on dental discount plans, visit DentalPlans.com.

Are there major differences across dental plans?

When comparing dental plans, you should review differences in waiting periods, deductibles, and annual limits. The average dental plan will have a 0% coinsurance for preventive services- cleanings, x-rays, fluoride treatments, and exams- and a 50% coinsurance for major services such as extractions. Annual limits range anywhere between $1,000- $3,000. While there are tons of companies offering dental insurance plans in New Jersey, it isn’t worth spending your time to research all of them. Speak with a broker to find a plan that suits your needs and meets your financial goals.

What is a dental annual maximum amount?

The annual maximum is the maximum amount of money your dental insurer will contribute toward the cost of your dental care in an either, calendar year or plan year. Usually, preventative and diagnostic serves do not count toward the annual maximum.

My dentist offers his own in-house dental plan, how does that compare with other dental insurance?

Many dentists are now offering their own in-house dental plans at competitive costs. Typically, these plans cost less than stand-alone dental insurance plan available on the market and will provide comparable coverage. The major downside is that you will be restricted to that one dentist office. If you personally like your dentist and do not intent to move residencies any time soon, an in-house dental plan may be suitable for you. Call your dentist to learn more information on the cost and coverage provided.

I currently have dental insurance through my employer. I will be retiring and signing up for Medicare soon. What should I do regarding dental coverage?

Typically, the date your medical coverage ends is also the date your dental insurance ends. Within 1 month of retiring, you should receive COBRA information in the mail from your previous employer. You will have the option to COBRA your dental insurance for 18-36 months. If the premium is manageable, it is suggested that you COBRA your dental insurance for as long as possible. After COBRA has ended, you should speak with a broker to determine whether dental insurance, a discount plan, or an in-house plan is appropriate based on your needs.

I just switched dental plans and the new policy has waiting periods. Am I eligible to waive them?

A waiting period is a specified amount of time you must wait after purchasing a policy before the new plan will provide coverage. Usually, waiting periods are only applicable to major work, such as root canals, and does not apply to preventative care. Many companies specify that if you had continuous coverage, you may be eligible to waive the waiting periods. This would require that you have no lapses in coverage between the old and new plan.

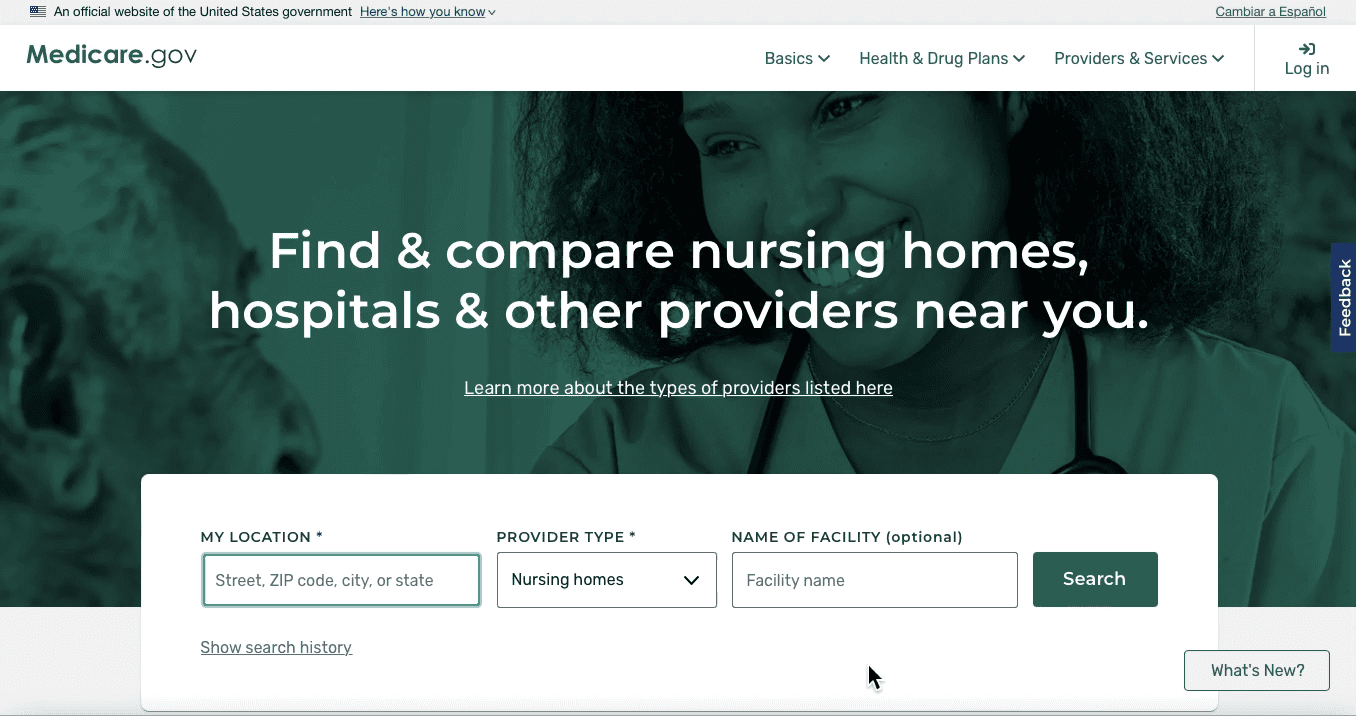

Does Medicare include dental coverage?

Medicare does not include dental insurance and therefore, will not cover routine dental procedures. Medicare will pay for dental services that are a fundamental part of a covered procedure such as jaw reconstruction following an accident. For more information on Medicare covered dental procedures visit CMS.gov. Free dental coverage is included in many Medicare Advantage plans as an ancillary benefit. Certain plans include free comprehensive coverage while others may require a small premium of about $20 to $30. Most plans have a $1,000 annual limit.

Can I add my spouse to my dental plan included in my Medicare Advantage plan?

No, you cannot add your spouse to your Medicare Advantage dental plan. He or she will need to apply for separate benefits through another Medicare Advantage, dental insurance, dental discount, or in-house plan.

Will my Medicare Advantage over-the-counter discount card cover dental products such as toothbrushes and whitening strips?

Most over-the-counter discount cards will allow you to apply benefits toward toothbrushes, toothpaste, floss, mouthwash, and denture cleanser tabs. Many will not allow funds to be used toward whitening strips. For more information on covered products, download your prospective discount card company app to view an online catalog and scan products in-store to determine if the product if eligible for discount benefits.

I haven’t seen a dentist in years and need to get major work done. Will a plan with a $3,000 annual cap be enough?

Dentists are generally aware of both your dental needs and financial restraints. With your annual cap in mind, most dentists will try to stretch your benefits as much as possible so that you can get the most amount of dental work done in a year before meeting your cap. If you plan on getting an extensive amount of work done on your teeth, you should expect all the work to get done over the course of a couple years. Most dentists will address major issues that are critical to your health prior to treating minor issues. It generally does not make sense to purchase another policy to receive more dental work.