Principal Broker

Laura Fagan

Licensed Life and Health Insurance specialist

Licensed in New Jersey, Pennsylvania, Florida, North Carolina, Colorado, New Hampshire, North Carolina, Indiana, Ohio, Texas, Vermont, Arizona, and New York.

Specialized in:

- Medicare Supplemental, Medicare Advantage, and Part D prescription drug plans

- ACA Marketplace Health Insurance

- Life Insurance

- Vision, Dental, and Hearing Insurance

- Hospital Insurance

- Retirement Income Planning

Our Mission

At Jersey Senior Advisors, our brokers are dedicated to servicing prospective clients who need assistance with individual health insurance in the ACA Marketplace or transitioning into Medicare Health Insurance. When there are so many advertisements, commercials, websites, and social media sources bombarding you with health insurance information, it can be difficult deciphering fact from fiction. We are here to provide you with the most up-to-date information and to make the ACA Marketplace, Medicare and other insurance as transparent as possible so you know exactly what to expect. We understand that no one plan fits all, so we ensure that the policies you are seeking suit your health and financial needs.

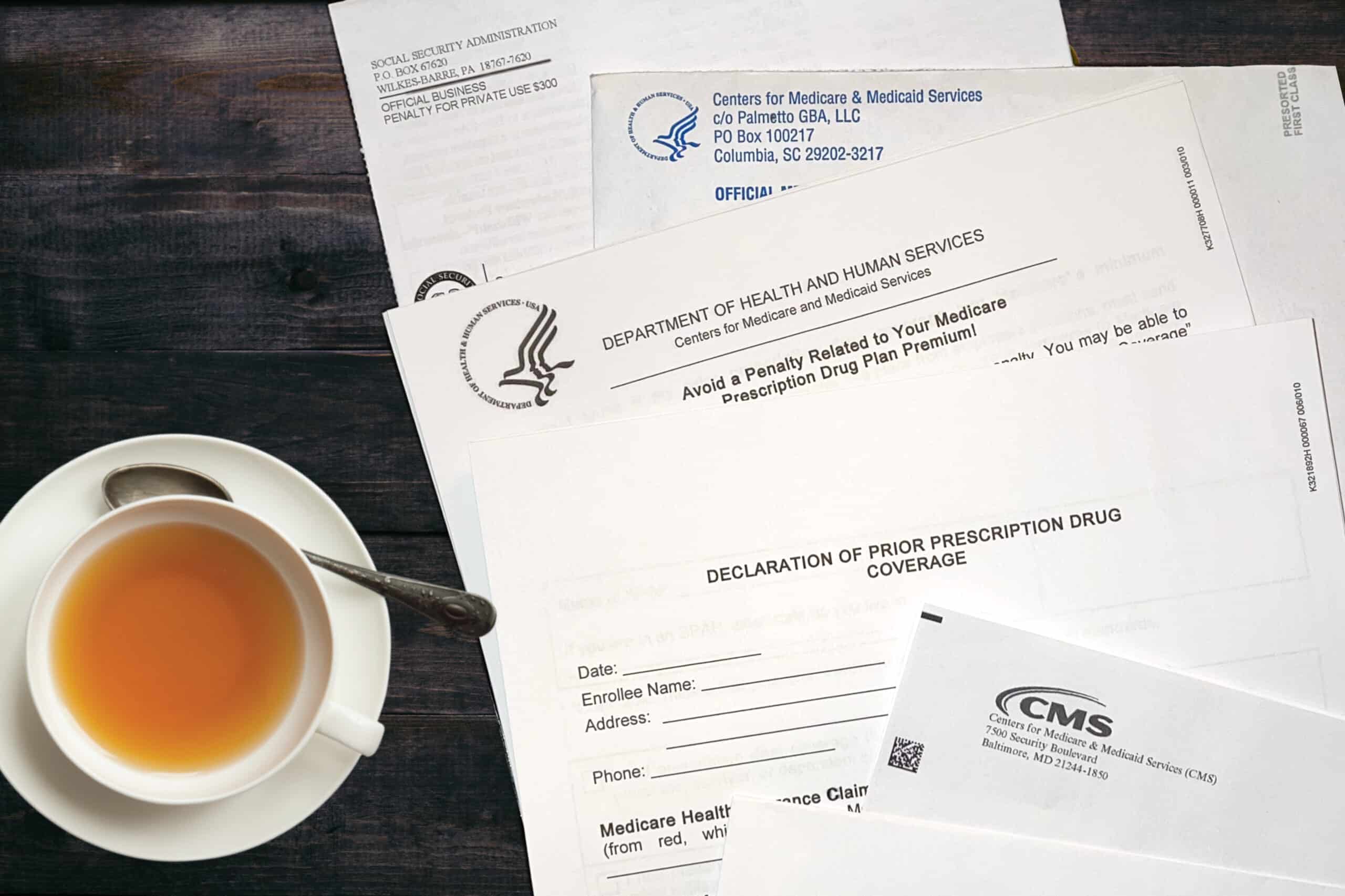

What is an insurance broker?

Insurance brokers are certified professionals who work for the client, not the insurance companies. Brokers contract with numerous life and health insurance companies, enabling them to compare premiums and policy benefits across companies. There is no need to call up each individual company to hear about all their “unique” features and “competitive” prices anymore. We take care of all that for you.

Agents, on the other hand, usually only sell products for one insurance company. Agents are often paid by salary, given sales incentives and quotas that may interfere with your needs. Additionally, many may be personally incentivized to sell products that yield higher commissions.

Why Us?

Good Question. There are a lot of insurance agents and brokers out there and it may seem like any agent or broker is as good as another. But we are decidedly different. Let’s face it, insurance jargon can be very confusing. We know the ins and outs of the insurance business, and our inside knowledge of multiple companies and a variety of insurance products will give you an advantage.

Your experience with us does not end once you enroll in a policy or hang up the phone. You will have the ability to contact your personal broker to answer your questions as they arise. We WANT to hear your concerns as they bring to our attention issues that may not have been foreseen. As the insurance industry continues to change, we rely on your feedback to expand our knowledge base and anticipate/prevent issues from arising in the future.

Broker FAQs

As brokers, we contract with many different life and health insurance companies to sell their respective products, though we do not work directly for any given company. Jersey Senior Advisors is not an insurance company, it is a brokerage.

Unfortunately, we cannot assist you with this issue as you did not purchase the policy from any one of our brokers. You will need to contact XYZ company directly to resolve your issue.

If we did not enroll you in the PDP plan, we cannot assist you with any issues you may encounter. Though, we can assist you with questions pertaining to your Medicare supplemental insurance.

All brokers must be nationally licensed with the Department of Banking and Insurance. Although our company is named Jersey Senior Advisors, we are contracted to offer life and health insurance products in most states. Even if we are not currently contracted with your given state, we can always obtain a non-resident license within 2-7 days.

At no point will you owe anything to your insurance broker. Whether it is before, during, or after an appointment, you will never be charged a fee. Brokers are paid by the insurance company you choose to enroll with. Broker compensation is often regulated; therefore, the broker receives the same compensation regardless of which insurance company you choose.

No. We are not licensed to sell property- homeowners or car insurance- and casualty insurance. We can recommend and refer you to independent brokers that specialize in property and casualty insurance.

When you enroll in a plan through a broker, the broker not only educates you on the product but is also available to guide you through any issues you may encounter. This reduces the likelihood of having to call customer service time and time again to inquire about simple issues. Additionally, you can expect a broker to provide you with insight on a company and their respective products whereas, agents working for the insurance company will certainly inform you that their products are “the best” as they want to make a sale.

Our brokers are licensed to sell group life, health, vision, dental, and hearing insurance. When considering group insurance, make sure to have key information available such as number of employees, benefits desired (vision, dental, and hearing), current insurance information, how much the employer will contribute, etc.

No. Appointments can be conducted over the phone, via Zoom, Google Meet, in-home, or at a common location.

Once you are ready to enroll, set up another appointment with your broker to complete an application. Remember, if you choose to enroll on your own, your broker will not be able to assist you with issues in the future. If we are not listed as Broker-of-Record, we cannot access your policy, troubleshoot, or call the insurance company on your behalf.