Vision Insurance In New Jersey

GET AN INSURANCE QUOTE!

What are the benefits of Vision Insurance in NJ?

Insurance may seem like just an another unwanted expense however once you learn why these types of insurance plans are important you will realize they are definitely worth it. Dental, vision and hearing health is linked to your overall well-being. NJ Vision insurance coverage will give you peace of mind and help you save money in the long run. And, believe or not, these insurance plans don’t have to be expensive either!

Jersey Senior Advisors can show you a number of coverage options you can tailor to your priorities and budget.

Insurance Quote

GET AN INSURANCE QUOTE!

VISION COVERAGE

In most cases, original Medicare does not include coverage for routine eye exams, eyeglasses, or contact lenses.

Normally Medicare will pay only following cataract surgery that implants an intraocular lens. Following that specific surgery, Medicare Part B will help pay for corrective lenses, one pair of eyeglasses or one set of contact lenses provided by an ophthalmologist.

However, the drawback is it will only offer this benefit once per lifetime and they only pay for a standard pair of eyeglasses. You would be responsible for the cost of upgraded frames.

Medicare Beneficiary?

Ultimately what we have found works best is for our clients is to enroll in a stand alone plan that combines the dental, vision and hearing benefits. The monthly premium is low and allows you to have more coverage than what you would normally be provided otherwise with just original Medicare.

How would I enroll?

Fill out the form and we will be in contact soon or press the “Click to Call” button above.

NJ Vision Insurance FAQs

What does vision insurance cover?

Vision insurance in New Jersey covers vision exams, contacts, eyeglasses, and frames. Typically, a higher premium is associated with more upgrades-tinting, scratch resistance, antiglare, and progressive lenses- at a lower out-of-pocket cost.

I buy a new pair of glasses about every 3-4 years. Is vision insurance necessary for me?

The value in vision insurance depends on how often you need to purchase new glasses or lenses and what kind of upgrades you wish to have. Individuals who have had the same prescription for years and don’t purchase glasses often, may benefit more from simply purchasing their lenses and frames from a wholesale grocer such as Costco, Sam’s Club, or BJ’s. On the other hand, vision insurance may be more appropriate for individuals whose eyesight appears to be getting progressively worse. Furthermore, vision insurance should also be considered by individuals who are accident prone or tend to misplace their glasses or contacts.

Will Medicare pay for glasses and contact lenses?

Medicare will not cover eyeglasses or contact lenses for correcting nearsightedness or farsightedness. Though, Part B of Medicare will cover corrective lenses- one pair of eyeglasses with frames or one set of contact lenses- following cataract surgery.

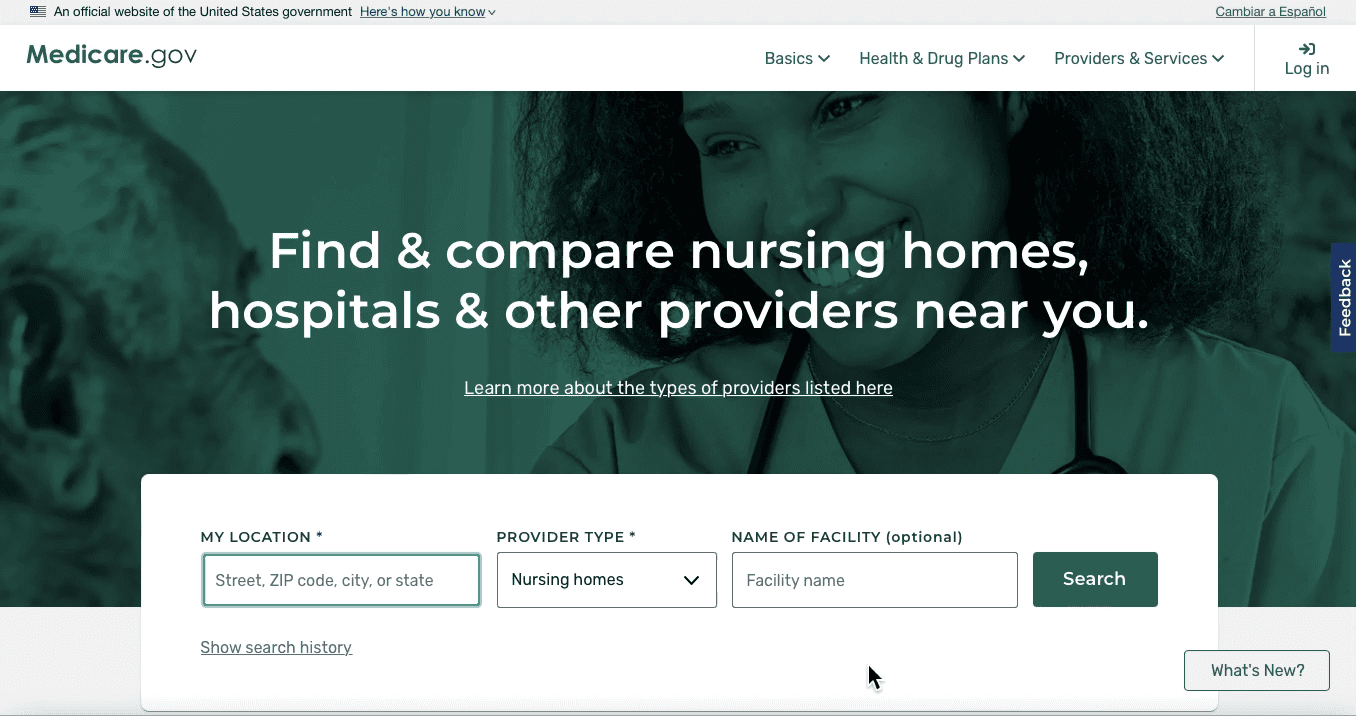

What eye related services will original Medicare cover?

Medicare will cover:

- An annual eye exam for diabetic retinopathy if you were diagnosed with diabetes

- An annual glaucoma test if you are considered a high-risk candidate

- Medicare approved diagnostic tests and treatments for eye diseases/conditions associated with age-related macular degeneration

- Cataract surgery

- 1 pair of prosthetic glasses or lenses supplied after cataract surgery with intraocular lens insertion

- Artificial eyes for patients with birth defects, trauma, or surgical removal of the eye

For more information, visit https://www.cms.gov/outreach-and-education/medicare-learning-network-mln/mlnproducts/downloads/visionservices_factsheet_icn907165.pdf

What eye related services will Medicare Advantage plans cover?

In addition to the eye related services covered by original Medicare, numerous Advantage plans include vision insurance as an ancillary benefit. Typically, you will receive one annual routine eye exam and yearly allowances for contact lenses and eyeglasses with the supplemental vision insurance.

How are the supplemental vision benefits offered by Medicare Advantage Plans delivered?

Depending on the insurer, the vision benefit may operate on a reimbursement system, through a contract with a separate vision insurance company, such as EyeQuest, or directly through the insurer’s vision insurance department, such as UnitedHealthcare Vision.

How is Lasik surgery covered?

Lasik (Laser in-situ keratomileusis) surgery is generally considered an elective procedure and most insurers will not cover the cost of the procedure. The cost of Lasik can be covered with:

- Financing

- Flexible spending account

- Health savings account

- Advertising promotions

- A health care credit card such as Care Credit

- Exclusive member discounts offered by vision insurers

I am retiring and transitioning to Medicare soon. Although I have never used it, I will be losing my vision coverage, what should I do?

When an employer offers vision insurance at no cost to you, there is no point in turning down such a great offer whether you need the insurance or not. Once you retire, you have the options of continuing the insurance through COBRA, terminating the coverage, purchasing a stand-alone vision plan, or obtaining vision benefits through a Medicare Advantage plan. Let’s make one thing apparent, you do not need vision insurance if you do not wear eyeglasses or contact lenses. Therefore, if your coverage was unnecessary before, it is going to be unnecessary now.

When should you use your medical insurance vs. vision insurance?

This can be a very confusing concept. Put simply, if the procedure is medically necessary, it will be covered through your medical insurance. Eyeglasses, frames, and contact lenses are covered through vision insurance in NJ. Optional elective procedures may not be covered through either and alterative payment options may need to be considered. If you are unsure if a procedure is covered, start by contacting your medical insurer first and then your vision insurer.

Will my medical insurer or drug plan cover the cost of prescription eye drops?

Prescription eye drops are covered through most medical insurers and Part D prescription drug plans. Unfortunately, just because a medication is covered, that does not mean that the medication will be cheap. In fact, most eye drops carry a big price tag even with insurance. Whether you shop around for drug plans or alternative eye drops, they will almost always carry a hefty copay. For cheaper alternatives visit https://www.goodrx.com/healthcare-access/drug-cost-and-savings/why-are-my-eye-drops-so-expensive