Term vs. Whole Life Insurance: Which Is Best for You?

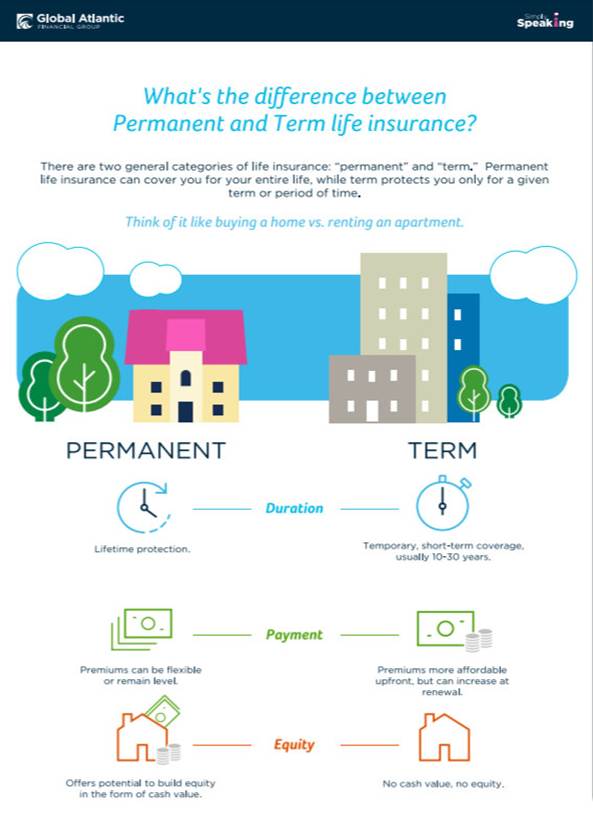

When it comes to life insurance, one of the biggest questions people face is: Should I choose term life or whole life insurance? Both options provide financial protection for your loved ones, but they work in very different ways. Understanding their differences can help you make the best decision based on your financial goals, budget, and long-term needs.

What Is Term Life Insurance?

Term life insurance is temporary coverage that lasts for a specific period, such as 10, 20, or 30 years. If you pass away during that time, your beneficiaries receive a death benefit. However, if you outlive the term, the policy expires, and you get nothing (unless you renew or convert it to a permanent policy).

Pros of Term Life Insurance:

Cons of Term Life Insurance:

What Is Whole Life Insurance?

Whole life insurance is a permanent policy that lasts your entire life, as long as you continue to pay premiums. It not only provides a death benefit but also builds cash value over time, which you can borrow against or withdraw under certain conditions.

Pros of Whole Life Insurance:

Cons of Whole Life Insurance:

Which One Is Right for You?

Choosing between term and whole life insurance depends on your financial situation and goals.

There’s no one-size-fits-all answer when it comes to life insurance. The best choice depends on your financial responsibilities, long-term goals, and budget. If you’re unsure which policy is right for you, we’re here to help! Contact us for a free consultation, and we’ll guide you through your options so you can make an informed decision.