Medicare 101: What the Heck Are All These Parts?

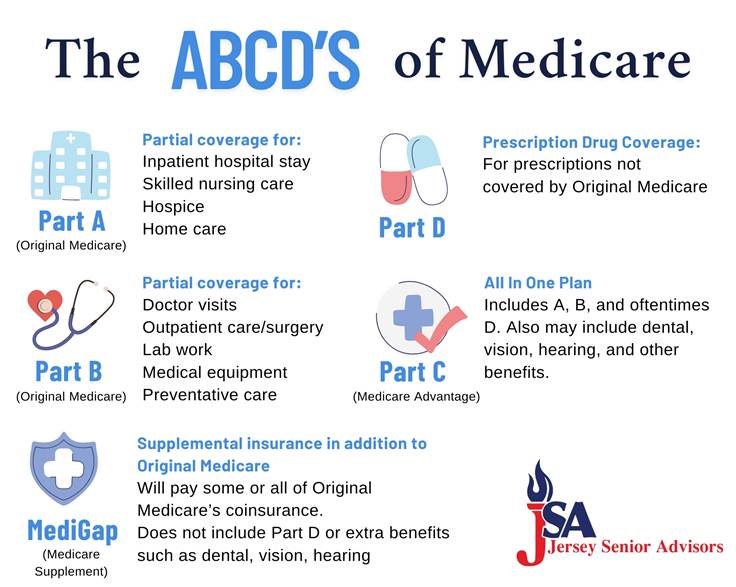

Navigating Medicare can feel like diving into a bowl of alphabet soup—Part A, Part B, Part C, and Part D—it’s a lot to take in! But don’t worry, we’re here to simplify things and help you understand how these parts work together to provide comprehensive healthcare coverage.

What Is Original Medicare?

“Original Medicare” consists of Part A and Part B, which you sign up for through the federal government.

Part A – Hospital Insurance

Part A covers:

✔ Inpatient hospital stays

✔ Skilled nursing facility care (after a qualifying hospital stay)

✔ Hospice care (for those who qualify)

The good news? For most people, Part A is free! You won’t pay a monthly premium if you’ve worked and paid Medicare taxes for at least 10 years.

Part B – Medical Insurance

Part B covers:

✔ Doctor visits and outpatient care

✔ Lab tests and preventive services (like screenings and vaccines)

✔ Durable medical equipment (such as wheelchairs and oxygen tanks)

Unlike Part A, Part B comes with a monthly premium, typically around $185 in 2025 (though higher-income individuals may pay more).

Why Original Medicare May Not Be Enough

While Original Medicare (Parts A & B) provides a strong foundation, it has significant gaps, including:

❌ High deductibles and copays

❌ No out-of-pocket maximum (meaning costs can add up quickly)

❌ No prescription drug coverage (which could lead to late enrollment penalties if you go more than 63 days without “creditable” drug coverage)

To fill these gaps, you have two main options:

Option 1: Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurance companies and bundle your Medicare benefits into one plan. These plans often:

✔ Have low or $0 monthly premiums

✔ Include prescription drug coverage

✔ Offer extra benefits like dental, vision, hearing, and even gym memberships

However, Medicare Advantage plans:

❌ Require copays for doctor visits, hospital stays, and tests

❌ Often have provider networks, meaning you may need to stay within a specific list of doctors and hospitals

Option 2: Medicare Supplement (Medigap) + Part D

With this option, you keep Original Medicare and add a Medicare Supplement (Medigap) plan to help cover out-of-pocket costs, plus a separate Part D prescription drug plan. This approach:

✔ Provides the greatest flexibility with no network restrictions

✔ Minimizes out-of-pocket costs

However, it can be:

–More expensive (Medigap premiums increase with age)

-Does not include dental, vision, and hearing coverage (though you can add these separately—typically around $50/month for dental and $30/month for vision)

Which Option Is Right for You?

Choosing between Medicare Advantage or a Medigap & Part D plan depends on your healthcare needs, budget, and threshold for risk.

We’re here to help you navigate these choices and find the best fit for your situation.

Schedule Your Free Medicare Consultation

Medicare can be confusing, but you don’t have to figure it out alone. Schedule a free consultation with us today, and we’ll walk you through your options so you can make the best decision for your healthcare future.

Call or text us at 732-708-6506 to set up a free consultation

Let’s scoop up the perfect Medicare plan together! 🍜🥄