Term vs. Whole Life Insurance: Which Is Best for You?

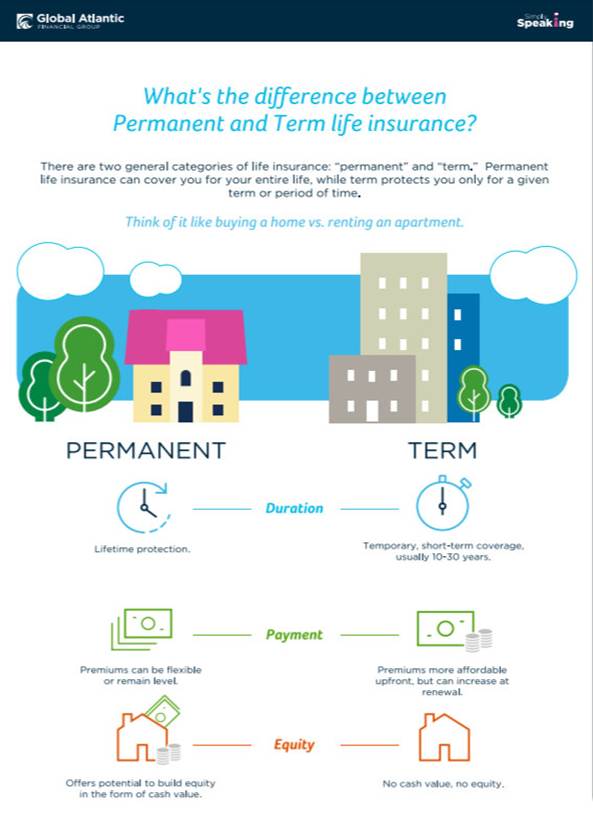

When it comes to life insurance, one of the biggest questions people face is: Should I choose term life or whole life insurance? Both options provide financial protection for your loved ones, but they work in very different ways. Understanding their differences can help you make the best decision based on your financial goals, budget, and long-term needs.

What Is Term Life Insurance?

Term life insurance is temporary coverage that lasts for a specific period, such as 10, 20, or 30 years. If you pass away during that time, your beneficiaries receive a death benefit. However, if you outlive the term, the policy expires, and you get nothing (unless you renew or convert it to a permanent policy).

Pros of Term Life Insurance:

✔ Affordability – Term policies are generally much cheaper than whole life insurance, making it easier to get a high coverage amount. ✔ Simple and straightforward – No cash value or complex investment components—just pure protection for your loved ones. ✔ Good for temporary needs – Ideal if you want coverage while paying off a mortgage, raising children, or reaching financial milestones.

Cons of Term Life Insurance:

✖ Coverage ends – If you still need insurance after the term expires, renewing can be expensive. ✖ No cash value – Unlike whole life insurance, term policies don’t build savings. ✖ Rates can increase upon renewal – If you develop health issues, it could be harder to get a new policy at a low rate.

What Is Whole Life Insurance?

Whole life insurance is a permanent policy that lasts your entire life, as long as you continue to pay premiums. It not only provides a death benefit but also builds cash value over time, which you can borrow against or withdraw under certain conditions.

Pros of Whole Life Insurance:

✔ Lifelong coverage – No need to worry about renewing your policy or losing coverage. ✔ Cash value growth – Part of your premium goes into a savings component that grows over time, tax-deferred. ✔ Predictable premiums – Your payments stay the same, making it easier to budget. ✔ Can be used as an investment – You can access the cash value while you’re still alive for emergencies, retirement, or other financial needs.

Cons of Whole Life Insurance:

✖ Higher premiums – Whole life policies cost significantly more than term life for the same death benefit. ✖ Slower cash growth – The cash value takes time to build and typically offers lower returns than other investments. ✖ More complex – With its investment component, whole life insurance can be harder to understand and manage.

Which One Is Right for You?

Choosing between term and whole life insurance depends on your financial situation and goals.

There’s no one-size-fits-all answer when it comes to life insurance. The best choice depends on your financial responsibilities, long-term goals, and budget. If you’re unsure which policy is right for you, we’re here to help! Contact us for a free consultation, and we’ll guide you through your options so you can make an informed decision.

📞 Call/text us at 732-708-6506